Andelsman Law is pleased to announce that Jacob Grossman, Esq., has been named an Associate.

Jacob earned his Juris Doctor degree from the Maurice A. Deane School of Law at Hofstra University in May 2023. His undergraduate studies were at SUNY Binghamton where he graduated in May 2020 with a Bachelor of Arts degree in Philosophy, Politics and Law. Jacob passed the NYS Bar Exam in October 2023, and was […]

Stopping Silent Sellers: New York State Amends The Property Condition Disclosure Statement Act

On September 22, 2023, New York Governor Kathy Hochul signed crucial legislation amending Sections 462, 465, and 467 of New York’s Real Property Law (“RPL”), otherwise known as the Property Condition Disclosure Statement Act (“PCDSA” or the “Act”). Changes to the Act shall be effective as of March 20, 2024, and shall apply to those […]

New York Legislature Passes LLC Transparency Act

On June 20, 2023, the New York State Assembly passed the LLC Transparency Act, (hereinafter referred to as “Act”), a groundbreaking bill set to enhance transparency and combat money laundering in the state of New York. The Act mandates the disclosure of all Beneficial Owners of Limited Liability Companies (“LLC”) formed within the state of […]

Audra Hornig, Partner Announcement

It is with great pleasure that we announce the promotion of Audra Hornig, Esq. to partner at Andelsman Law. Audra has been an integral part of our firm’s success, showcasing unwavering dedication and hard work since joining us five years ago. Throughout her tenure, she has consistently demonstrated a commitment to excellence, a profound understanding […]

Andelsman Law To Participate in 2023 NYC Real Estate Expo

Larry Andelsman will be on a panel titled “The State of Private Lending: What Are You Seeing Today“, and the team will also have a booth.

CEMA transactions can reduce refinancing costs in New York, but private lenders must be diligent about following the process.

Long-term rentals have exploded in the private lending space during the last several years. Private lenders entering the New York market who want to be competitive must understand and be able to handle CEMA, a unique regulation pertaining to long-term rental assets. There are no CEMA regulations in other states, and lenders can face unexpected […]

New York’s Newly Enacted Foreclosure Abuse Prevention Act and its Effect on Private Lenders

On December 30, 2022, Governor Kathy Hochul signed into law the “Foreclosure Abuse Prevention Act” (§5473). The Foreclosure Abuse Prevention Act (“FAPA”) puts a hard six-year statute of limitations on foreclosure proceedings and controversially will take effect retroactively. FAPA applies to all pending foreclosure actions and will have a drastic impact on certain actions in […]

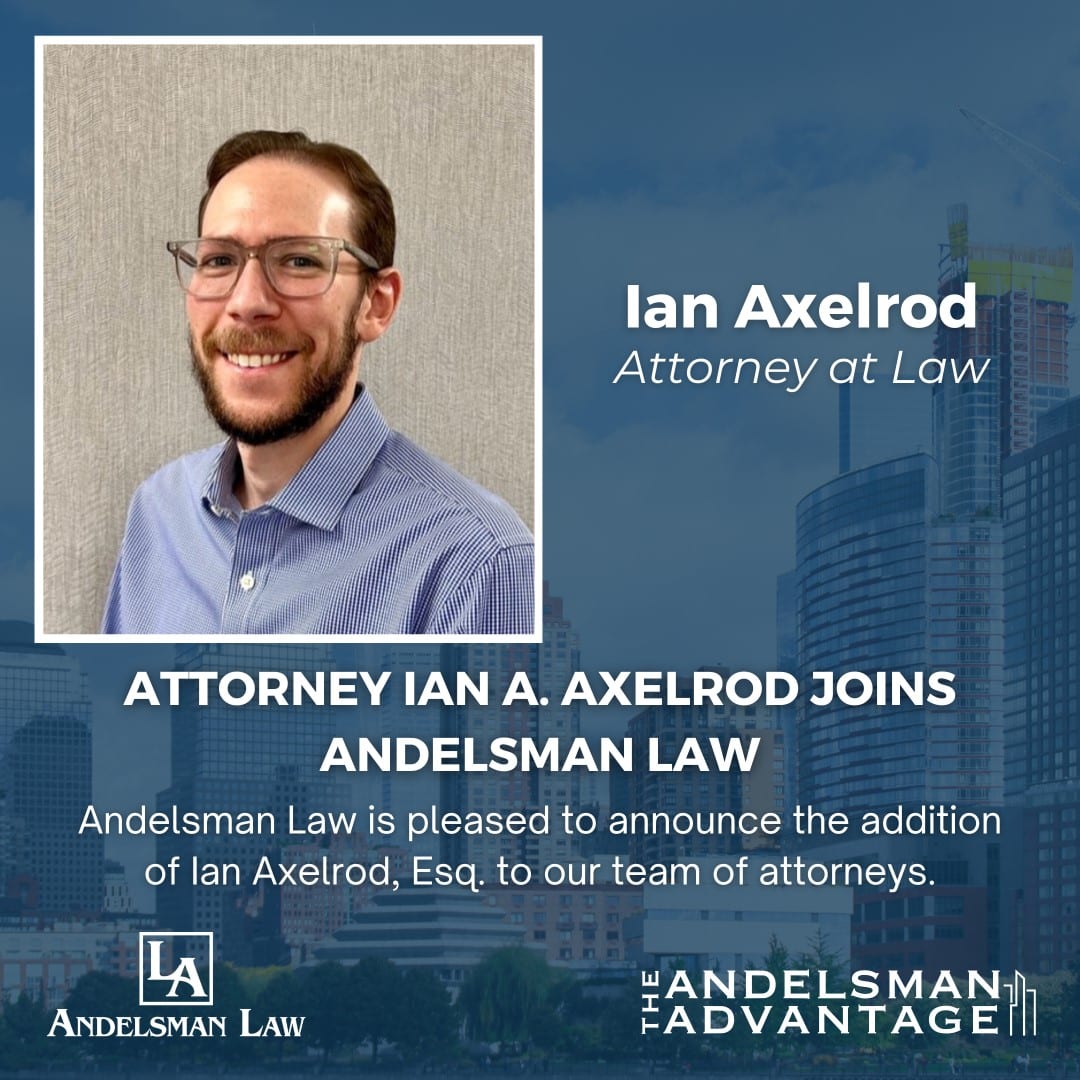

Attorney Ian A. Axelrod Joins Andelsman Law

Andelsman Law is pleased to announce the addition of Ian Axelrod, Esq. to our team of attorneys. Ian has joined the firm as Senior Counsel and will manage the Commercial Real Estate Group. Ian is an accomplished attorney with a primary focus on representing private lenders, financial institutions, investors, developers, and domestic and international high […]

Andelsman Law Recognized For Charitable Work

Andelsman Law is honored to have won the Charitable Impact Award at Captivate 2022

Real Estate Investors Establishing Relationships With Private Lenders For Real Estate

The focal point for real estate investors, particularly those new to the business, is to have the ability to have cash available to propel their investment strategy. Private Lenders provide capital and flexibility that strengthen investors’ ability to close deals and grab market share. Establishing relationships with lenders that can fund quickly and that have […]